Israel/Gaza: The Economic Consequences of War, the Economic Prospects for Peace

Wars are costly—so can Israel afford not to turn a truce into a more lasting peace?

Israel cannot continue its war on Gaza indefinitely—not so much owing to grueling moral quandaries or unbearable ethical qualms, but due to strictly fiscal and macroeconomic concerns, with all the political-economic consequences that an expensive war must have for both Israeli society and state in the coming year.

In fact, any desire to end the war on Israel’s part—beyond the terms of the temporary truce negotiated by Qatar—is likely to have very little to do with strictly moral reasoning, much less international law. Israel is not a state party to the Rome Statute, and consequently, the International Criminal Court holds no sway over Israel; and in the face of international criticism, Netanyahu seemed to double down on his Gazan policy in the war’s first 45 days. All the rhetoric and actions of Israel’s far-right-influenced government suggest that appealing to the conscience of Netanyahu with reference to the more than 5,500 Palestinian children killed so far[1]—with another 1,500 children reported missing by mid-November,[2] likely trapped under the rubble of Gaza’s destroyed or damaged housing stock, estimated at 50%—is unlikely to yield tangible results. Instead, economic concerns are likely to play a far more important role in driving the Israeli government to pursue a more lasting peace deal.

The reasons are straightforward: The war is dealing significant damage to the Israeli economy, and any state must sooner or later contend with the economic consequences of war, no matter how righteous its cause might seem to both leaders and voters.

Currency Troubles, Declining Consumer Confidence

First, some relevant data points. A weekly analysis report from the Israeli bank Leumi,[3] published one month after Hamas’s October 7 attacks, shows that Israel’s currency fared better than feared in the first month of war, with the “exchange rate of the shekel vis-à-vis the US dollar return[ing] to its pre-crisis level.” After the attacks, the shekel weakened significantly against the dollar, reaching a nadir two weeks out from the October 7 attacks. There were palpable concerns among analysts and central bankers that a continued currency depreciation would cause rising import and manufacturing input prices, with predictable inflationary effects.

This was avoided, however, solely due to the Bank of Israel’s resolute, costly, and (in recent memory) unprecedented intervention in currency markets to prop up the shekel. The central bank “announced a program to sell up to US$30 billion in foreign exchange, and a program to make swap transactions up to $15 billion in the foreign exchange market” in the weeks after the attack.[4] Recall that Israel’s foreign exchange reserves only stood at slightly less than 200 billion dollars in September 2023,[5] meaning the central bank was forced to sell some 15 percent of its reserves to prop up its currency in the wake of October 7. One Bank of Israel head noted, “We are in an unprecedented security situation, and our estimate was that the market could get to a situation of divergence without the announcement of our intervention.”[6] Divergence is, of course, just a central banker euphemism for currency catastrophe.

Bank Leumi’s Capital Markets Division emphasizes how exceptional this move was: It “came following a period that began in January 2022 during which the central bank was not active at all in the foreign exchange market.” The central bank’s actions were further exceptional because “for the first time in 15 years” the central bank “sold foreign currency” (see Figure 1). To reiterate: Israel’s central bank had not sold foreign currency in a decade-and-a-half, a pattern broken only because of the October 7 attacks, indicative of Israeli central bankers’ concern that the nation’s currency was in for a rough ride, with predictable results for the domestic economy.

Figure 1. Source: https://english.leumi.co.il/static-files/10/LeumiEnglish/Economic_Weekly/leumi_weekly_08.11.23_english_acc.pdf

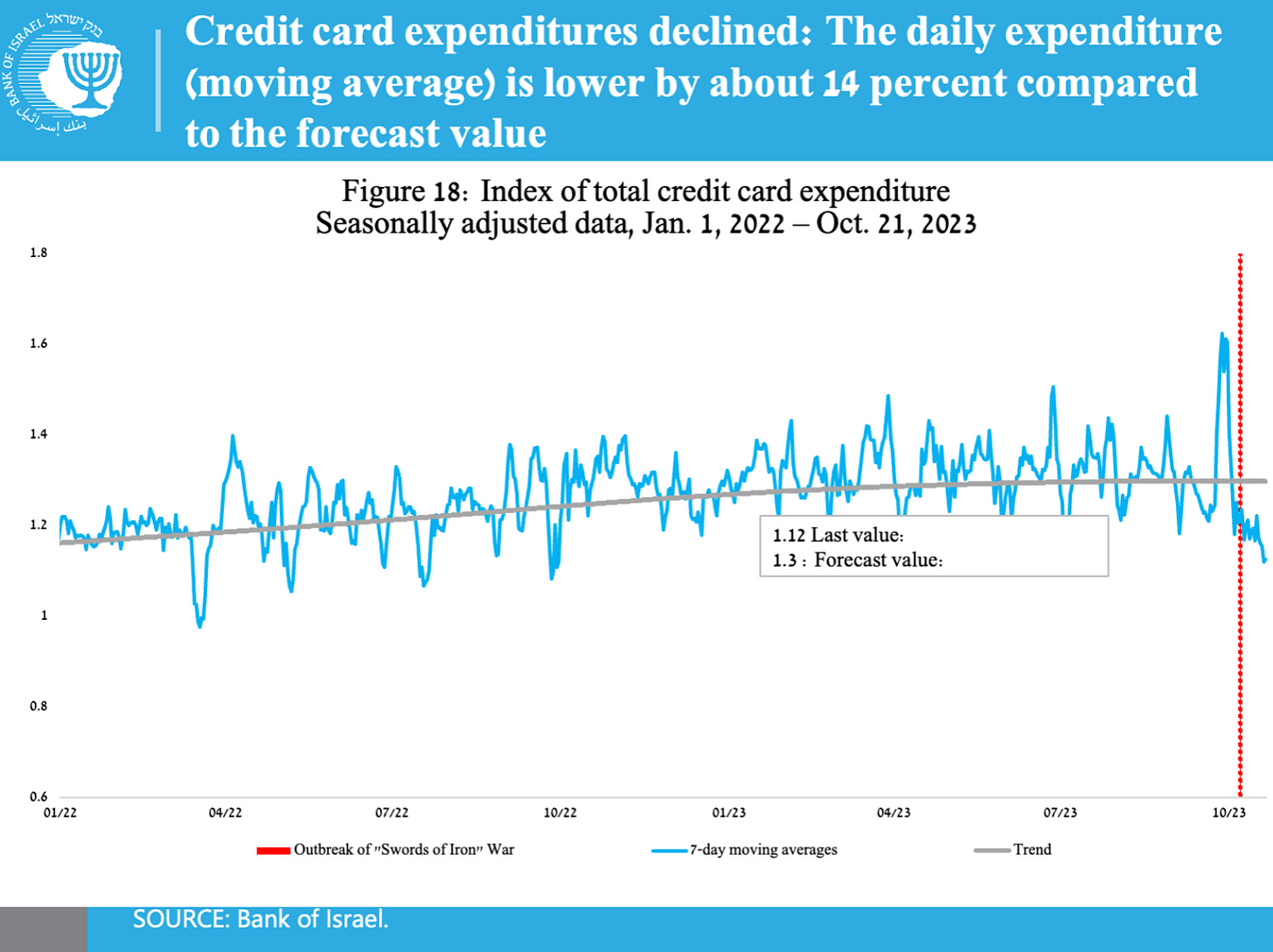

While significantly adverse effects on the currency were staved off—but not before taking a significant chunk out of the country’s foreign exchange reserves—consumer spending took a real hit after the October 7 attacks. As Figure 2 shows, credit card spending in Israel declined appreciably, “lower[ed] by about 14 percent compared to the forecast value,” according to the Bank of Israel—a pre-October 7 forecast, that is. Meanwhile, the market research firm Ipsos’s Global Consumer Confidence report in November 2023, tracking consumer sentiment in 29 countries, showed that out of all these countries, ranging from the U.S. to Turkey and beyond, “sentiment is down most of all in Israel (-5.6 points).”[7] The one-year decline was even greater: Compared with November 2022, Israeli consumer confidence had fallen by 10 percent over the preceding 12 months.

Figure 2. Source: https://www.boi.org.il/media/xyadg02z/2023-10-october-23-interest-rate-decision.pptx

The All-Importance of Labor

Far more important were ongoing, chronic labor shortages, probably the key contributor to the war’s negative economic impact. Some 360,000 reservists were called up on October 10, and as the New York Times reported a month later, most of those thousands of reservists were busy doing exactly nothing: “For now…the hardest part is the waiting.”[8] Remember that Israel’s total labor force only stood at 4.37 million workers prior to the war.[9] Pulling nearly one in ten out of the labor force—or 8.23 percent to be more precise—would be detrimental to any economy and certainly fiscally burdensome: All those boots on the ground come with hungry mouths to feed and bank accounts in need of replenishment from government coffers.

In fact, no need to guess about the extent of this costly endeavor: On November 9, more than a month after the attacks, the war cost the Israeli economy “an estimated NIS 2.3 billion ($600 million) a week, or about 6 percent of the weekly GDP,” according to central bank research, mainly due to the call-up of reservists, but also owing to an estimated 200,000 people relocated from areas bordering on the Gazan theater of war.[10] By November 22, the Times of Israel was reporting on a survey conducted by the Manufacturers Association of Israel, showing that “the absence of workers is posing an acute problem” for manufacturers.[11] Indeed, some sectors were hit harder than others. Tourism declined precipitously: Arrivals by air quickly declined to levels not seen since the tail-end of the pandemic in 2021,[12] and Reuters reported that October 2023 saw a paltry 99,000 visitors, “most designated as tourists…versus 369,000 in October 2022 and 485,000 in pre-pandemic October 2019,” according to Israel’s Central Bureau of Statistics.[13]

The construction industry was adversely affected as well. Some 90,000 Palestinian laborers were estimated to have been working in Israel’s construction industry pre-October 7, but the attacks “prompted Israeli authorities to revoke their work permits.”[14] The Israel Builders Association, an organization representing firms in the construction industry, was reportedly “negotiating with India,” its vice president said, hoping in lieu of Palestinian workers to “engage 50,000 to 100,000 workers from India to be able to run the whole sector and bring it back to normal.” The construction industry, vital to any thriving economy, was no longer able to function without cheap, docile Palestinian labor; other foreign laborers would have to be brought in to resuscitate the industry.

The real estate market as a whole seemed increasingly in a parlous state, too. In an interview with an investment officer in a leading Israeli investment house, a journalist asked, “What’s your forecast for the Israeli real estate market?”. The answer was forthright:

“At the moment, it’s completely frozen. There are hardly any sales of new homes, because financing costs have risen so much. Also, workers are not coming in from Judea and Samaria [i.e. the Occupied West Bank] and from Gaza, and some of the foreign workers have left.”[15]

Even the Bank of Israel’s rose-tinted economic forecast of October 23 could not conceal the fact that the War on Gaza was macroeconomically damaging:

“Under the assumption that the war will be concentrated on the southern front during the fourth quarter of the year, GDP is expected to grow by 2.3 percent in 2023 and by 2.8 percent in 2024. It is expected that the impact to economic activity will lead to an increase in the government’s budget deficit, which will reach 2.3 percent of GDP in 2023 and 3.5 percent of GDP in 2024. In view of this, the debt-to-GDP ratio at the end of 2024 is expected to be 65 percent.”[16]

The assumptions are worth paying close attention to: This better-than-feared outcome was predicated upon the war remaining limited to Gaza, or “the southern front,” without further regional conflagration, and the war would have to remain restricted to the tail-end of 2023. If moderate economic growth and a debt-to-GDP ratio of 65 percent by the end of 2024 was going to be realistic, according to Israel’s central bank, Netanyahu would need to wrap up the war in short order.

A Worsened Economic Outlook

The lid could not be kept on the bad economic news coming out of Tel Aviv. By November 21, nearly 45 days out from the war’s start, the Times of Israel was reporting that credit rating agency Moody’s had cut its growth forecast for the country quite severely. Moody’s now “expects [the] economy to contract 1.5% in 2024, with 18% of Israel’s workforce absent during war.”[17] The agency noted a report from the Institute for National Security Studies, affiliated with Tel Aviv University, suggesting that the war’s price tag could be “as much as NIS 150 billion to NIS 200 billion [$40-53 billion], equal to up to around 10 percent of gross domestic product.” And the credit rating agency “put the Israeli government’s A1 credit ratings on review for downgrade.”[18]

Similarly, only a week earlier, the ratings agency Standard & Poor’s had published an equally muted report detailing the state of Israel’s economy, citing “‘lower business activity, depressed demand from consumers, and a very uncertain investment environment,’ as well as the massive call-up of reservists, as reasons for the downturn.”[19]

Could this be part of the motivation for the late November ceasefire? As the newspaper Haaretz noted, Israel’s military forces began rolling out vacation leave to “soldiers fighting in Gaza, following expected cease-fires” on November 23 not simply because they had been on duty for a month and a half and wanted, or needed, a break: It was to “allow them to return to their jobs, [and] also to alleviate the damage to the economy.”[20] The ceasefire was less a grand humanitarian gesture to the Gazan population, nor solely aimed at bringing Israeli hostages home, but also sought to restore macroeconomic solidity. With nearly 10 percent of the labor force out of commission and on the government payroll, and with international ratings agencies cutting their outlooks for the future of the Israeli economy, increasingly it appeared as if Netanyahu could not afford to keep the war in Gaza going indefinitely.

And this was the case even with U.S. military and financial support: Biden’s announced $14.3 billion aid package earlier in October came with multiple strings attached and caveats that restricted its macroeconomic utility.[21] It is worth taking a closer look at President Biden’s request for supplemental funding from Congress.[22] First, $4.4 billion of the package was not so much aid to Israel as a boost to U.S. domestic military spending, including money for “replacement, through new procurement or repair of existing unserviceable equipment, of defense articles from the stocks of the Department of Defense”—in other words, money to replenish U.S. armament supplies. Another $4 billion was devoted to funding Israel’s Iron Dome systems, with a further $1.2 billion to “Iron Beam defense system capabilities.” Finally, and perhaps most importantly for our purposes here, $3.5 billion would be spent on “Foreign Military Financing” of Israel’s armed forces—still a drop in the bucket when Tel Aviv University-affiliated researchers were claiming the war might cost in the order of 40-50 billion dollars.

While it would be foolish to discount the importance of the injection of U.S. military aid, only a proportion of this money would be spent on covering the direct operational expenditures a state would need to devote to placing hundreds of thousands of boots on the ground, and this proportion would itself not be matched by the true scale of the costs of war: Defensive rocket systems, yes; ammunition and missiles, yes; but not so much the “political economy” of war. And while some of this cash certainly freed up Israeli state spending to be devoted to other budgetary items, it seemed unlikely that U.S. aid packages alone would be able to prop up Israel’s economy as such.

In short, the war is slowly bleeding the Israeli economy—perhaps not dry, but surely resulting in a slow trickle that over time will undermine the livelihoods of ordinary Israeli voters. A shrewd and discerning political leader must necessarily take this into account.

While reporters and commentators in the West have given a surprising amount of coverage to the suffering of Palestinian civilians in the wake of Israel’s Gaza War, far less analytic firepower has been trained on the economic consequences of the war. And yet it is these fiscal, monetary, and economic effects that hold out the best hopes for peace.

Practically overnight, this has come to constitute conventional wisdom among Israeli economic analysts as well. “No end to the war in the Gaza Strip is yet in sight,” the Senior Equity Markets commentator Hezi Sternlicht of the Israeli business newspaper Globes intones, “but this is an event that will eventually pass, and its intensity is expected to decline in the first quarter of 2024.”[23] And as already noted, Israel’s central bank similarly made the assumption in its October 23 outlook that “that the war will be concentrated…during the fourth quarter of the year.” People who think about the Israeli economy for a living seem increasingly to be planning around the prospect of peace with the onset of the new fiscal year.

Does Netanyahu realize that he cannot afford to allow the war to drag on indefinitely? If he does not, his political opponent Yair Lapid, who has repeatedly called for Netanyahu’s resignation after the Hamas attacks, will only be further strengthened.

Given the affective state of current Israeli politics, however, it is far from certain that the patent irrationality if not outright unrealism of keeping a small, vulnerable economy on a war footing for an extended period will be permitted to affect policy. Wars can be waged in deeply irrational ways: The United States spent $2.31 trillion on the War in Afghanistan in the two decades following 9/11, with very little to show for it.[24] But Israel is not America; its economy in 2022 was roughly the size of Norway’s. The bill is coming in—and fast. The economic, and hence political, consequences will not be pleasant if the war drags on much longer—certainly not for the Palestinians, but from the vantage point of Israeli military-political-economic strategy, not for the Israelis either.

References

[1] https://www.hrw.org/news/2023/11/22/israel/gaza-hostilities-take-horrific-toll-children

[2] https://www.ochaopt.org/content/hostilities-gaza-strip-and-israel-flash-update-45

[3] https://english.leumi.co.il/static-files/10/LeumiEnglish/Economic_Weekly/leumi_weekly_08.11.23_english_acc.pdf

[4] https://www.boi.org.il/en/communication-and-publications/press-releases/b23-10-23/

[5] https://www.boi.org.il/en/communication-and-publications/press-releases/c09-10-23/

[6] https://www.reuters.com/markets/currencies/bank-israel-sell-30-bln-forex-moderate-shekels-volatility-2023-10-09/

[7] https://www.ipsos.com/en/november-2023-singapore-sees-sharpest-increase-consumer-confidence

[8] https://www.nytimes.com/2023/11/06/world/middleeast/israeli-reservists.html

[9] https://data.worldbank.org/indicator/SL.TLF.TOTL.IN?locations=IL

[10] https://www.timesofisrael.com/war-is-costing-economy-some-600m-a-week-due-to-work-absence-bank-of-israel/

[11] https://www.timesofisrael.com/worker-absence-due-to-war-poses-main-hurdle-for-manufacturers-survey/

[12] https://www.cbs.gov.il/he/mediarelease/DocLib/2023/355/28_23_355b.pdf, Figure 3

[13] https://www.reuters.com/world/middle-east/tourism-israel-drops-sharply-october-amid-war-with-hamas-2023-11-06/

[14] https://www.dw.com/en/israel-hamas-war-will-indian-workers-replace-palestinians/a-67417429

[15] https://en.globes.co.il/en/article-cheapest-stock-market-in-the-western-world-1001462965

[16] https://www.boi.org.il/en/communication-and-publications/press-releases/b23-10-23/

[17] https://www.timesofisrael.com/war-with-hamas-to-cost-nis-1b-a-day-hit-economy-harder-than-previous-conflicts/

[18] https://www.timesofisrael.com/war-with-hamas-to-cost-nis-1b-a-day-hit-economy-harder-than-previous-conflicts/

[19] https://www.timesofisrael.com/credit-rating-agency-sp-sees-israels-war-economy-shrinking-5-in-fourth-quarter/

[20] https://www.haaretz.com/israel-news/2023-11-22/ty-article-live/israeli-cabinet-okays-deal-for-release-of-50-hostages-held-by-hamas-temporary-cease-fire/0000018b-f52c-d117-abcf-f7ef5d450000

[21] http://www.vox.com/world-politics/2023/11/18/23966137/us-weapons-israel-biden-package-explained

[22] https://www.whitehouse.gov/wp-content/uploads/2023/10/Letter-regarding-critical-national-security-funding-needs-for-FY-2024.pdf

[23] https://en.globes.co.il/en/article-cheapest-stock-market-in-the-western-world-1001462965

[24] https://watson.brown.edu/costsofwar/figures/2021/human-and-budgetary-costs-date-us-war-afghanistan-2001-2022